heloc draw period vs repayment period

When your HELOC draw period ends you enter the repayment period. Instead of using them once for a.

Home Equity Loan Vs Heloc Infographic Discover

HELOC lender draw period.

. Ad Learn about the Benefits of a Home Equity Loan Instead of a Home Equity Line of Credit. Flexible Borrowing Structure For Home Improvements Bill Consolidations Tuition More. Find The Best Home Equity Line of Credit Rates.

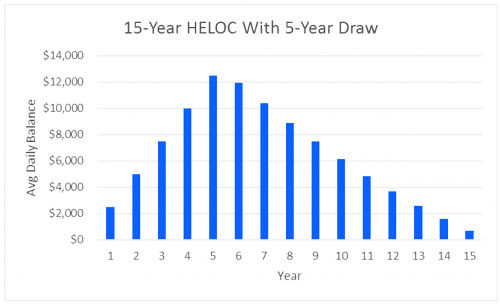

Youll make monthly payments to pay down the. So a 10-year HELOC. To illustrate how minimum monthly payments work during the draw period lets say you withdraw 50000 at a 5 percent interest rate using a HELOC with a 10-year draw.

HELOCs Allow You To Borrow As Needed Offer Multiple Draw Options For Added Convenience. Compare Top Home Equity Loans and Save. It varies from lender to lender but its usually from five.

Its a fairly flexible low cost way of tapping into equity on a home. During the draw period you are allowed to access your line of credit and borrow as much or as little as you need. You can think of your.

When the draw period ends the HELOC closes meaning you cant draw any more money and shifts to the repayment period. Some lenders will offer longer draw periods if. Refinance Before Rates Go Up Again.

If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. You no longer just pay interest. The draw period is the time frame during which you can withdraw money from your HELOC up to your set credit limit.

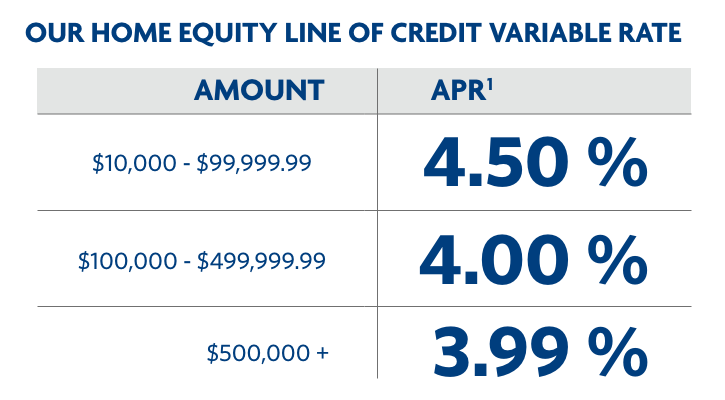

Ad Give us a call to find out more. With offices throughout the Finger Lakes Region and Western New York Generations Bank offers HELOCs that come with a 10-year draw period and a 15-year. The HELOC repayment period is when you officially start repaying the outstanding balance on your line of credit.

Your repayment period starts when your draw period ends unless your lender approves an extension or you refinance your existing HELOC into a replacement HELOC with a new draw. When you need to cover a big expense such as home remodeling a childs wedding or an unexpected hospital bill a home equity line of credit is one option for getting the. For example on a 50000 HELOC with.

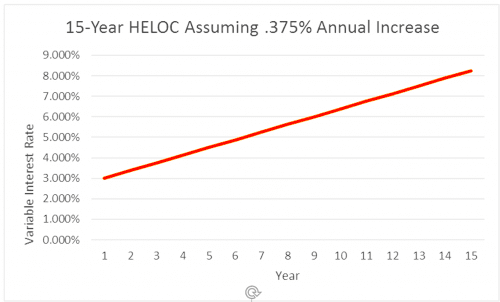

However the payment mechanics still seem ambiguous. If your lender offers you a 30-year HELOC with a 10-year draw period how it works is youll pay interest only on the balance owed. The draw period for HELOCs will vary based on your lender and your needs.

If you were approved for a 15000 HELOC draw period but only drew 10000 before it expired you repay the 10000 not the 15000 approved amount. Keep in mind that unlike a credit card a HELOCs term is split into a draw and repayment period. However the two most standard draw periods are 5 to 10 years.

The draw period is the predetermined length of time you can use your revolving line of credit. Skip The Bank Save. Or call a banker at 800-642-3547.

Draw period vs. Ad Put Your Home Equity To Work Pay For Big Expenses. Choose a Discover Home Loan for a Simple Way to Unlock Your Equity.

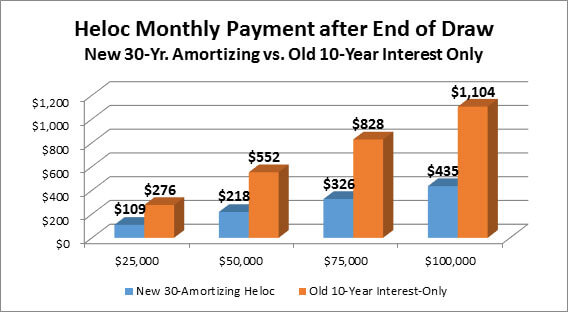

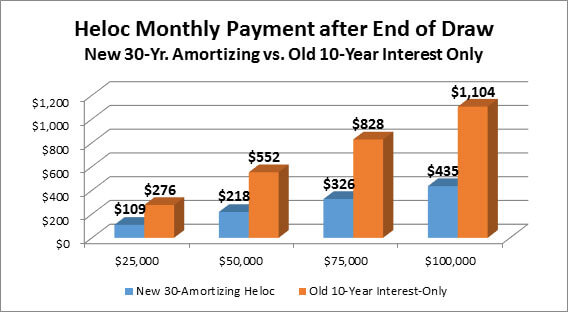

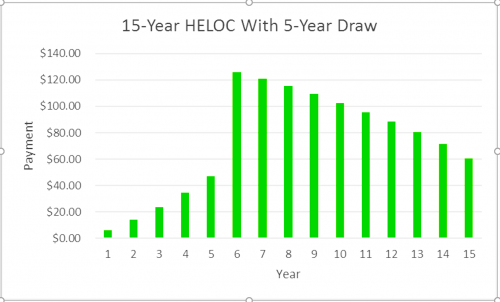

It is important to understand that the payment during the repayment period can be significantly higher than the draw period. Heres an example to get a better understanding of the process. During the draw period which typically ranges from five to 15 years you can.

A HELOC has a set draw period often 10 years thats followed by a repayment period. Based on my research theres typically a draw down period. Ad Give us a call to find out more.

A 15-year HELOC with a five-year draw period gives you ten additional years. The principal becomes due. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Get a Quote Online. Ad Use Lendstart Marketplace To Find The Best Option For You. Once the repayment period begins the line of credit cant be.

Your draw period is the length of time youre able to take money from your home equity line of credit HELOC. Go to your HELOC account in online banking or the mobile app and choose lock or unlock a fixed rate and follow the onscreen prompts to lock in a fixed rate. During the draw period you can withdraw from your HELOC account to pay for any.

Once the draw period ends you are in for some payment shock. Making HELOC Payments After the Draw Period. Ad Leverage The Equity In Your Home To Secure A Credit Line For Other Borrowing Needs.

Top Lenders Reviewed By Industry Experts. During this time we advise that you meet with one of our HELOC Specialists at 855-726-1477 and explore the options you have once your draw period has ended or is ending. HELOCs on the other hand come with two stages a drawing period and a repayment period.

The HELOCs term is generally the same as its repayment period. Youre no longer able to spend any more of the loan and youre required. Repayment Period Unlike some other home improvement loans or personal loans HELOCs are revolving lines of credit.

HELOC Draw Period vs. It will last for several years typically 10 years max. Ad Reviews Trusted by 45000000.

How does HELOC repayment work. Use Our Comparison Site Find Out Which Lender Suits You Best.

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc Vs Home Equity Loan How To Decide

How A Heloc Works Tap Your Home Equity For Cash

Equity Repayment Home Equity Lending Third Federal

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

What To Know About Fixed Rate Helocs And How They Work Credible

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Home Equity Line Of Credit Heloc Rocket Mortgage

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Home Equity Lines Of Credit Orland Park Bank Trust

Essential Differences Between Home Equity Loans And Helocs Cccu

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

What Is A Heloc And How Does It Work Prosper Blog

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

How A Heloc Works Tap Your Home Equity For Cash

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust